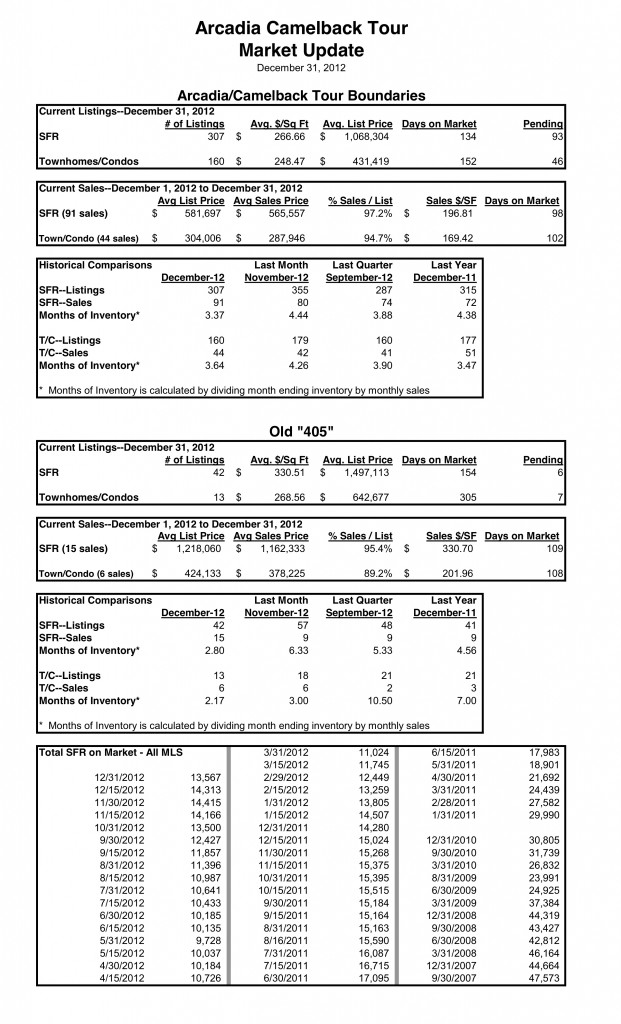

There have been plenty of notifications of new listings coming to the market now that the holidays have wrapped up, expect sales activity to remain strong as Sellers and Buyers ramp up for the New Year.

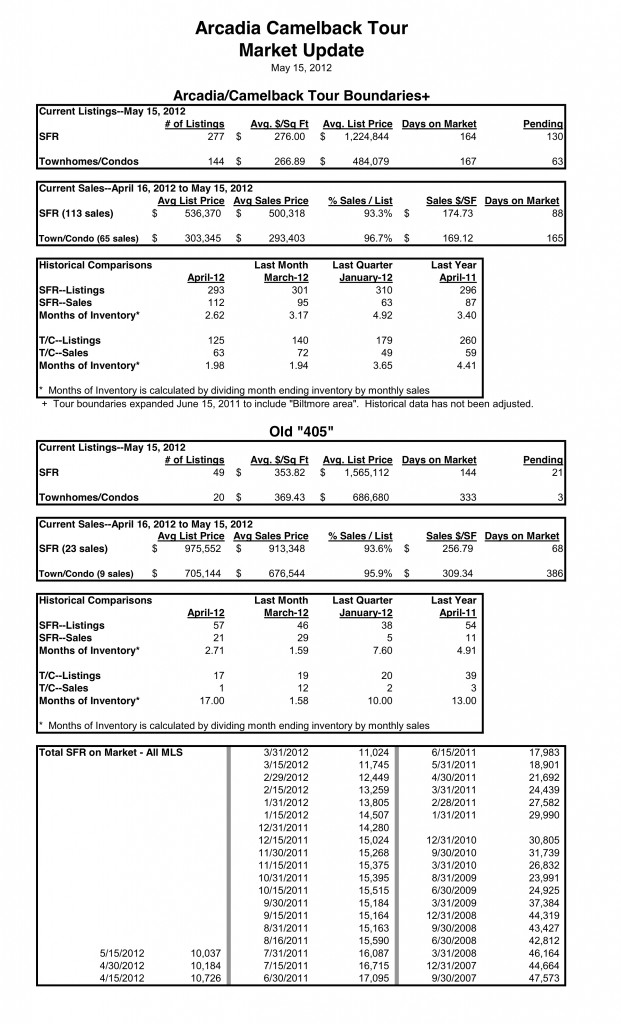

See the latest Arcadia-Camelback Corridor Real Estate Statistics below!

Inventory levels still falling, falling, falling…

Inventory levels still falling, falling, falling…