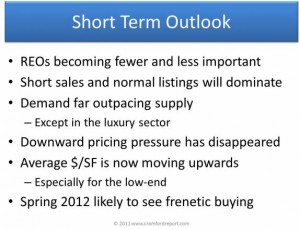

This article below was on the front of the USA Today, continuing a trend of recent positive articles about the Phoenix Housing Market. The press is always a little behind the actual market, as we’ve seen this firsthand for months, and with the inventory as low as it is in many areas the competition is extreme for desirable properties both for investors and owner occupants. See below:

The Phoenix housing market is showing signs of improvement, even generating bidding wars among buyers for lower-priced homes.

By Tom Tingle, The Arizona Republic

The area was one of the hardest hit by the foreclosure crisis. Prices had fallen 57% from their peak. Interest rates were near record lows.

Now, “We list a property and, within two or three days, we have multiple offers,” says Keith Krone of Keller Williams Realty in a Phoenix suburb.

While frustrating for buyers attempting to get homes at rock-bottom prices, it’s a healthy sign of healing in a market scorched by the housing bust five years ago, say local Realtors and real estate experts.

The area’s January home sales were up 8.1% year-over-year. Multiple offers are common on lower-end homes, investor-buyers say. And the inventory of homes for sale is now well below the 10-year average, says Michael Orr, real estate expert at Arizona State University.

National data watchers have also seen improvements in Phoenix. In October and November, it was the only one of 20 major cities to see home values rise month-to-month, according to Standard & Poor’s Case-Shiller home price index, which reports December results today.

Phoenix “is probably the best example we have right now of a hard-hit market that’s showing signs of recovery,” says Zillow economist Stan Humphries.

Making money on rentals

Strong demand for rental homes is boosting the market, Orr says.

While home prices plummeted in the downturn, rents haven’t, he says. That’s lured mom-and-pop and institutional investors who are buying single-family homes to turn them into rentals.

In January, more than 25% of homes sold were bought by investors, Orr says. Historically, they account for 10% of Phoenix home purchases.

Investor demand for homes priced below $100,000 is “frenetic,” says Laurie Hawkes, president of American Residential Properties. The real estate investment firm has bought almost 800 Phoenix-area homes in the past three years and turned them into rentals.

Last year, cash buyers accounted for about 94% of purchases for homes that sold for less than $100,000, she says.

The homes are often filled with people who lost single-family homes to foreclosure, Hawkes says.

Job growth in the Phoenix area has also outpaced state and national averages since mid-2011, says a December report on the region by Moody’s Analytics. That drives rental demand, too.

Prices are responding in the lower end of the market, says James Breitenstein, CEO of Landsmith, an investment firm that’s bought 225 Phoenix-area homes in the past year to rent out.

“Houses we used to buy for $50,000 are now creeping up to $60,000 or $70,000,” he says.

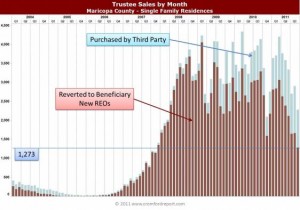

Arizona’s relatively fast foreclosure process is also helping to clear inventories of distressed homes. The state is among those that do not require court approvals of foreclosures.

About half the states do, including New York and Florida. In judicial foreclosure states, foreclosures have taken longer to complete. New rules since 2010 to ensure that foreclosures are done properly have extended time frames even more.

In Phoenix, it would take about 20 months — half the national average — to liquidate all homes currently in foreclosure or more than 90 days delinquent on loans, based on current foreclosure sales rates, says mortgage tracker LPS Applied Analytics.

A new government plan launched Monday should hasten the clearing of inventories of distressed homes, says Jim Belfiore, of Belfiore Real Estate Consulting in Phoenix. The government is offering to sell some foreclosed homes owned by Fannie Mae in Phoenix and other cities to investors to turn into rentals.

Improved affordability

In addition to investors, first-time buyers are also active, as are vacation home buyers and people who lost homes earlier in the downturn, says Arthur Welch of Realty World Superstars in the Phoenix suburb of Buckeye.

More traditional buyers are also in the market, Belfiore says. “People who have sat on the sidelines sense that the bottom has been hit,” he says.

When compared against median incomes, Phoenix homes are 15% more affordable now than they were on average from 1985 to 2000, Zillow says. Record-low mortgage rates, around 4%, stretch buyers’ dollars further.

Zillow expects Phoenix home values to rise 0.6% this year, vs. a 3.7% drop for the nation. Through November, Case-Shiller data show Phoenix home values down 3.6% year-over-year vs. a 3.7% decline for an index of 20 leading cities.

Phoenix still faces big challenges.

Last year, the region posted the nation’s sixth-highest metropolitan foreclosure rate, based on foreclosure filings by housing unit, market researcher RealtyTrac says.

As those homes hit the market, they’ll drive home prices lower, says Moody’s analyst Daniel Culbertson. Meanwhile, new single-family home construction will remain “lethargic,” he wrote in the December report.

What’s more, almost half the Arizona homes with mortgages were underwater at the end of September, says researcher CoreLogic. That compares with about a fifth of homeowners nationwide who owe more on their mortgage than their homes are worth.

It’s harder for underwater homeowners to sell and then buy other homes. Normal resales in Phoenix aren’t seeing higher prices yet, Orr says.

Still, he says the market is poised for a “significant rise” in prices at the lower end. “We will have to wait and see if this possibility turns into reality,” he says.

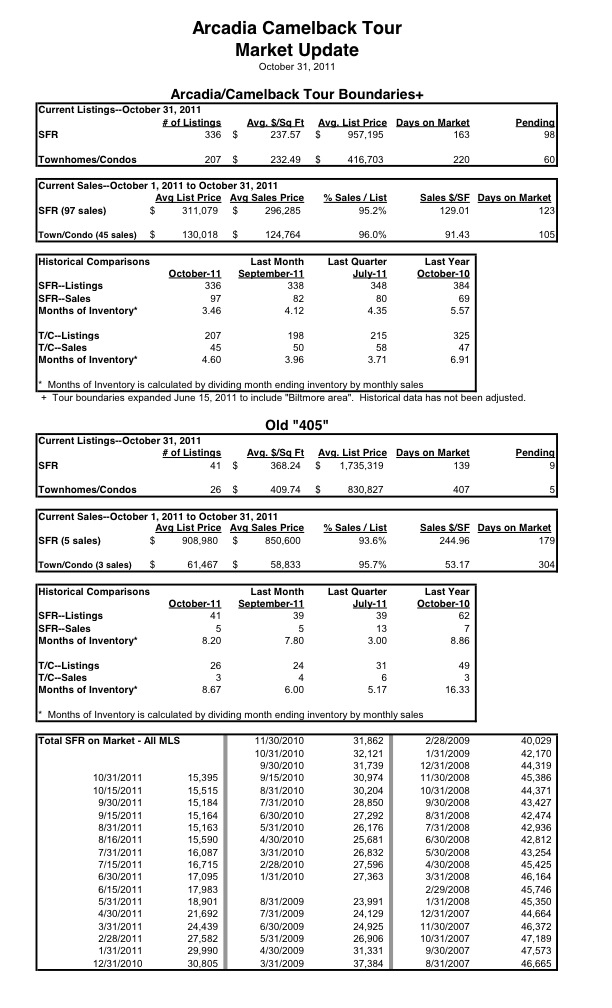

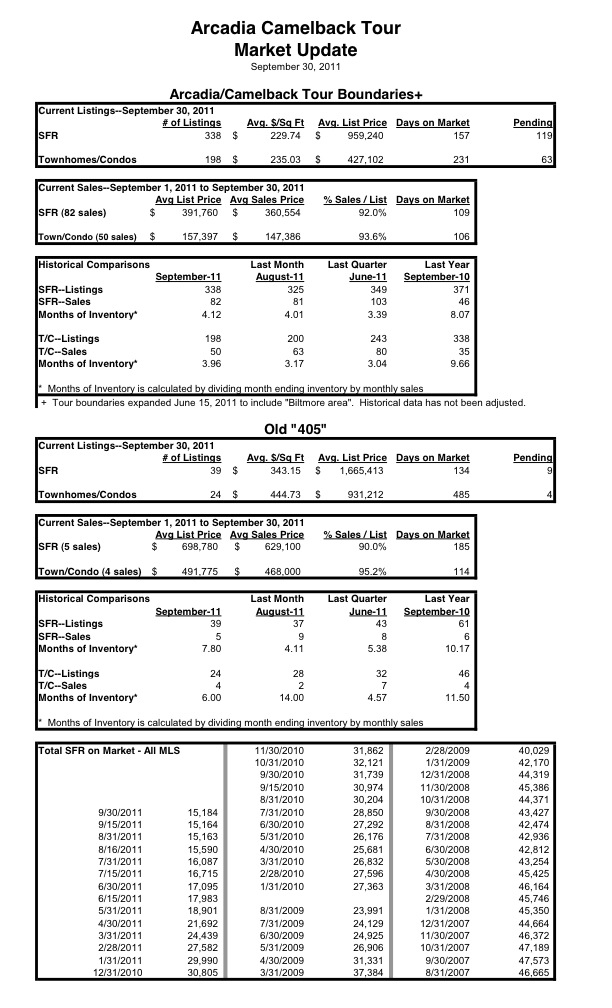

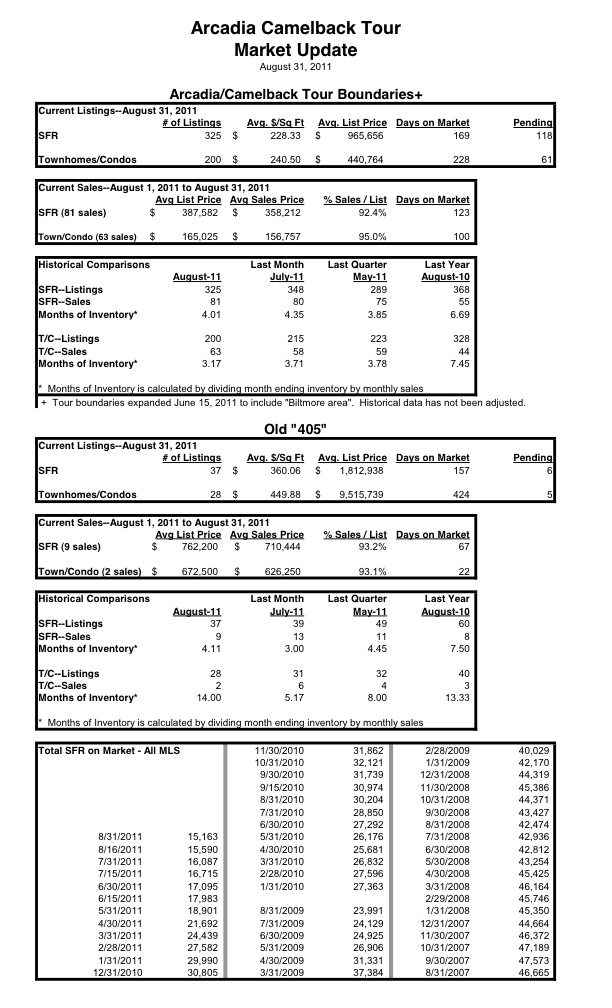

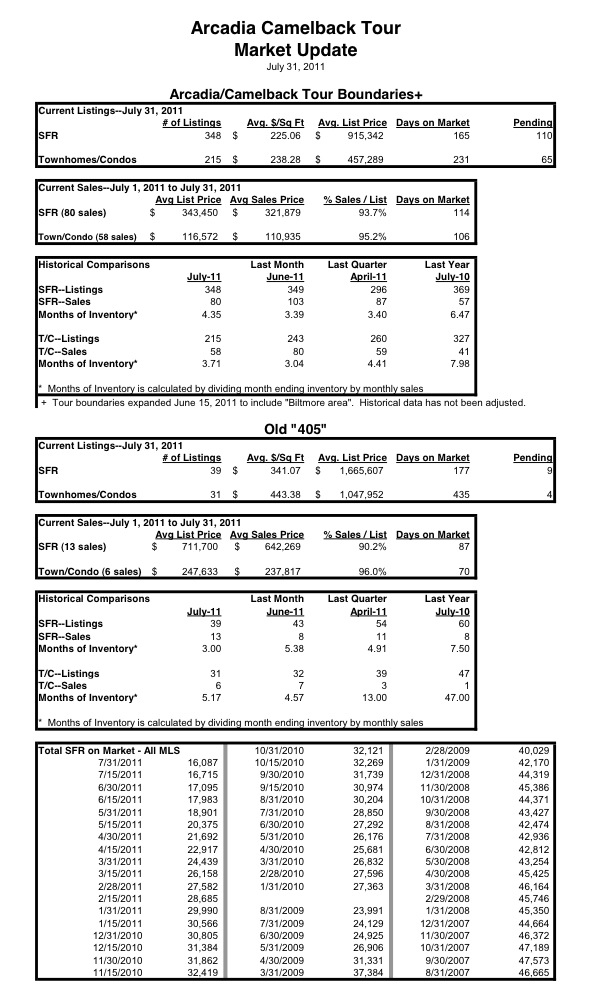

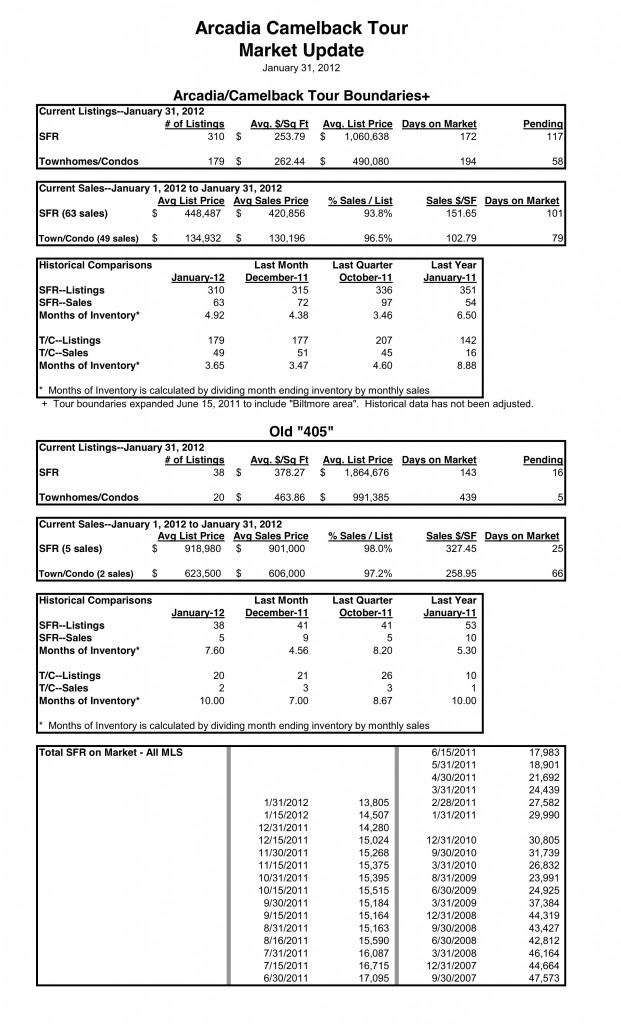

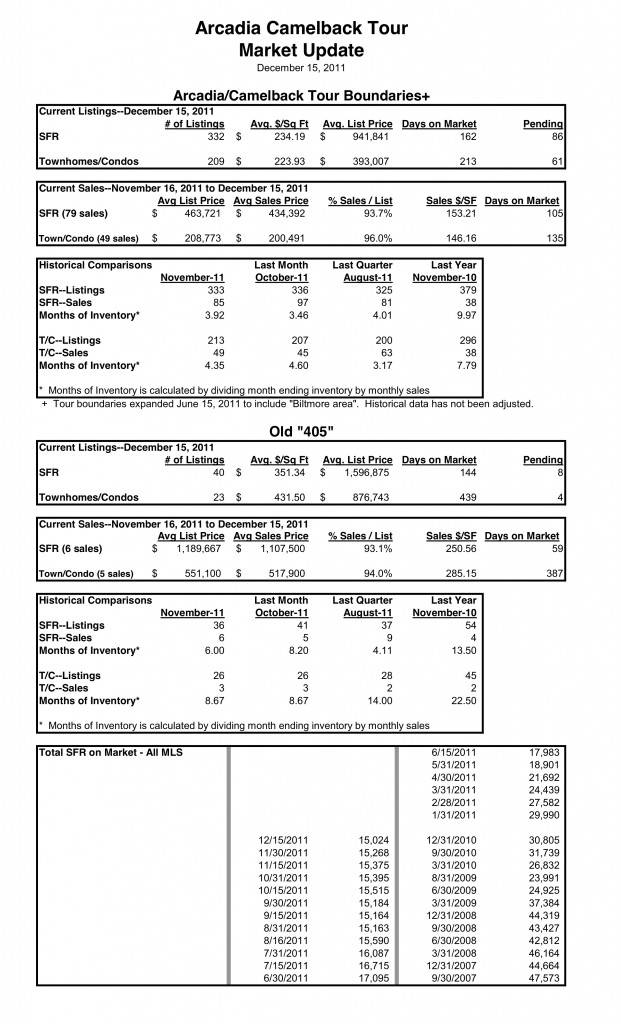

Latest inventory & sales staistics in the Arcadia area of Phoenix. See below!

Latest inventory & sales staistics in the Arcadia area of Phoenix. See below! Listings by Distressed Type:

Listings by Distressed Type: