It’s surprising that this is not getting a little more press:

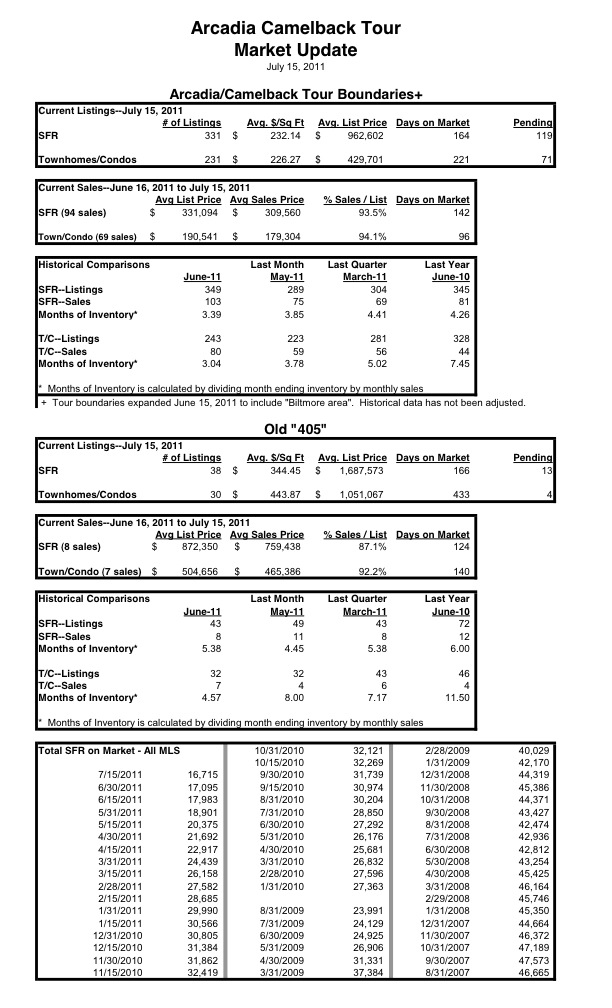

Listing inventory is dropping weekly, now down below 20,000, and only 16,000 of those Single Family Detached Homes. That trend continues every week. Only a year ago there were around 30,000 in the MLS.

Sales activity is on the rise, and rising every month. June was the best month in the Phoenix Metro area since 2005. That’s right, the best month in sales in 6 years.

Foreclosures, while still high, are slowing and the percentage of the market from June of last year dropped from 38% to 32%. And every month, the trend seems to show that the pace is decreasing by about 500 properties per month. And, the number of total licensees here in Arizona, and Realtors nationwide is dropping.

I have a few Buyers at the moment that literally can’t find something decent on the market in their price ranges, it wasn’t long ago that a Buyer had their pick of the litter.

No one can predict where we’ll go from here but the market has seen an interesting turn in the last few months in the central Phoenix metro area. See attached Arcadia Camelback Stats and related MLS stats below!