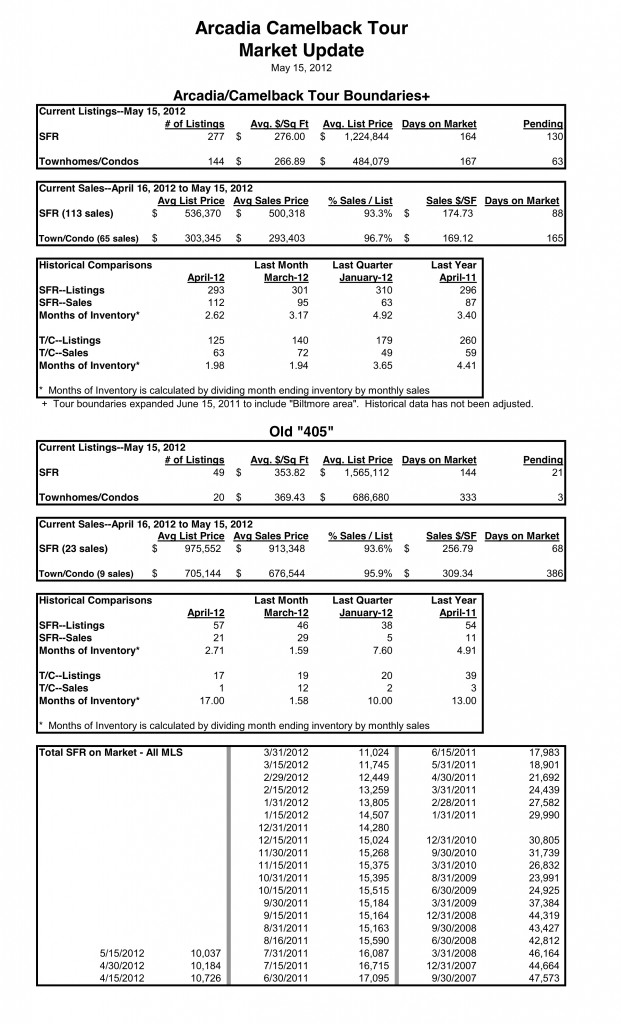

Here is the latest Arcadia Tour stats for this week…as you can see Buyers are still hunting for bargains, almost a $100 dollar per square foot difference between asking and sold prices. See below!

Arcadia Real Estate, Camelback Corridor Homes, Phoenix Investment Property - Reckling Properties

Arcadia Real Estate, Camelback Corridor Homes, Phoenix Investment Property - Reckling Properties

Here is the latest Arcadia Tour stats for this week…as you can see Buyers are still hunting for bargains, almost a $100 dollar per square foot difference between asking and sold prices. See below!

What’s your home worth? It depends on who’s asking and what they want to know.

If you’re like many homeowners, the tumultuous events of the past few years have left you

wondering: What’s my home worth today?

Surprisingly, that seemingly simple question has more than one answer. “Your home may have

three very different price tags depending on who’s asking and why they want to know,” says

Scott Halliwell, a certified financial planner professional at USAA.

Your home’s three price tags are based on its market, replacement and property tax values,

Halliwell explains.

“Since different values can be used for different reasons, it’s important to understand when

each applies,” Halliwell adds. “Further complicating matters for some homeowners is the fact

that these values may be moving in different directions at the same time.”

Here’s a description of each value and why it’s important for you to know each one.

Market Value

This is the most commonly referenced calculation of your home’s value. It’s the price a buyer

would pay for your home in today’s housing market, no matter what you paid for it or how much

you’ve added in updates and upgrades.

Why it’s important to know

If you’re planning to sell your house,

market value is what you hope to get for it.

“In a buyer’s market like we see in a lot of

areas today, your home’s market value

may be lower than you’d like. You might

not have as much leverage against a buyer who wants to negotiate, but it’s where you need to

start,” Halliwell explains. An experienced real estate agent can gather information on the selling

prices of similar homes in your area, which will help you set reasonable expectations for your

home’s selling price.

You also should know the market value so you can calculate how much equity you have in your

home. Home equity is calculated by subtracting the amount you owe on your home from its

market value. Today, most lenders will allow you to borrow up to 70% to 80% of the appraised

value of your equity using a home equity line of credit or home equity loan.

Replacement Value

In the event of a total loss, replacement cost helps you rebuild your home based on current

construction costs in your area.

Replacement value can include the additional cost of tearing down and hauling away the old

structure. Also, homebuilders offer volume discounts that can drive down the price of new

homes and may not necessarily reduce replacement costs.

Why it’s important to know

Replacement value is the number that insurance companies use to determine the amount of

dwelling coverage needed in your homeowners policy. As building costs go up, it’s important for

your home to be adequately protected with homeowners insurance.

“It’s very possible to see local building costs increase while market values decline,” says

Halliwell. “This can lead to a situation where you actually need more dwelling coverage, despite

seeing your home’s value drop.”

Having one’s home damaged or destroyed is a tragic event, but not having enough money to

rebuild makes it even worse, Halliwell says.

Property Tax Value

This is the number used by taxing authorities to calculate your property tax bill. A given home

may be taxed by more than one property tax jurisdiction — hospital and school districts, for

example — and each may apply its own math. Typically, property tax values are meant to

approximate the market value.

Why it’s important to know

The property tax value of your home is going to drive your property tax bill. Sometimes, there’s

a big discrepancy between the property tax assessment and the market value. Perhaps this is

due to the assessment being outdated, which could cause your homeowner’s tax bill to be too

low or even too high. If the property tax value of a home exceeds the market value, consider

contesting the value with your taxing authority to reduce your tax bill. Also, be aware that

certain actions, such as remodeling, could cause the property value to be reassessed and

result in a larger tax bill in the future.

Metro Phoenix home prices continued to rapidly climb in May.

The median sales price of a home in the region is up 32 percent from May 2011, according to the latest report from the W. P. Carey School of Business at Arizona State University.

During last month alone, the cost to buy a Phoenix-area house climbed 7 percent to $147,000. The region’s home prices have rebounded back to early 2003 levels.

More regular buyers and investors coupled with a shrinking supply of homes for sale are propelling metro Phoenix home prices higher.

ASU housing analyst Mike Orr said in his report “high demand and low supply” remain the dominant factors in Phoenix’s housing market.

The number of homes for sale in the area is down 50 percent from May 2011. Currently, 8,550 homes are listed for sale and don’t have pending contracts from buyers.

Moderately-priced homes continue to draw the most buyers and bids.

“Most houses below $250,000 priced realistically are attracting large numbers of offers in a short time, and many exceed the asking price,” said Orr, director of the Center for Real Estate Theory and Practice at W. P. Carey School.

He said a Chandler owner recently received 84 offers, and a Glendale owner snared 95.

The Glendale house closed within four weeks for 17 percent above the original asking price.

“Needless to say, this is not something we would see in a normal market,” Orr said.

Metro Phoenix home prices can’t continue to climb at the “extremely fast rate” recorded in the past few months.

“The most likely time for prices to stabilize is during the hot summer months of June through September,” Orr said.

Read more: http://www.azcentral.com/business/realestate/articles/20120627metro-phoenix-home-prices-continue-rise.html#ixzz1z8YMSkxG

Inventory levels climbed back above 10,000 SFR homes, but we are still running at nearly 20% of the inventory from peak levels. Sales/pending activity remains strong. We’ll see how the heat of the Summer affects real estate activity! With the short supply of homes available, it could remain strong…

See below!

Inventory levels still falling, falling, falling…

Inventory levels still falling, falling, falling…

Inventory levels contine to fall across the valley, and the tour areas are near low levels. 23 SFR homes in the “True Arcadia” area selling in the past month (and another 21 in a pending status)! See below:

This article appeared in Sunday’s Az Republic Real Estate section 4/29/2012…

Do Open Houses Help Homes Sell?

Does holding an open house make a home more likely to sell?

To answer this question, we analyzed over a quarter million listings across eleven different cities around the United States.

In San Francisco, an astonishing 83% of listings held at least one open house. In Phoenix and Las Vegas, less than 5% of listings had an open house. In the remaining cities, 20% – 65% of listings had an open house.

?

Apparently every weekend is open-house weekend in San Francisco. In fact, holding an open house is so expected there that homes that don’t hold an open house are a full seven percentage points less likely to sell than those that do.

In Las Vegas and Phoenix, where open houses are rare, the exact opposite is true. Homes that don’t hold an open house are 17 percentage points more likely to sell than those that do.

Everywhere else, the picture gets a little more fuzzy. In the other eight markets we examined, there was virtually no difference in the percentage of homes that sold, whether they had an open house or not.

?

But what happens if we break that data down a little further and take a separate look at homes that held an open house specifically within the first week of listing versus those that held an open house at some later date?

?

Interestingly, when an open house is held within the first week, a home is 13 percentage points more likely to sell than not having an open house at all, and 26 percentage points more likely to sell than if an open house is held sometime after the first week.

So is there some sort of magic that makes a listing so much more likely to sell if you hold an open house in the first week? Probably not.

What’s more likely is that an open house in the first week is just a sign that your listing agent is working hard to do everything he or she can to sell your home. In contrast, an open house later in the life of a listing is a sign of desperation—a “Hail Mary” attempt to move a listing that simply isn’t priced correctly or doesn’t show well.

So should you hold an open house? If you’re in San Francisco, absolutely. If you’re in Phoenix or Las Vegas, probably not. Everywhere else, it most likely doesn’t really matter whether or not you hold an open house, but if you’ve got a good agent, he or she will probably hold one anyway.

Another article that was on the front page of the Az Republic a couple days ago details the strong competition for houses now that the inventory has fallen. This is especially true of the Arcadia, Downtown and other central Phoenix locations! See below:

| Phoenix-area homebuyers squeezed out by investors |

![]()

![]()

This article below was on the front of the USA Today, continuing a trend of recent positive articles about the Phoenix Housing Market. The press is always a little behind the actual market, as we’ve seen this firsthand for months, and with the inventory as low as it is in many areas the competition is extreme for desirable properties both for investors and owner occupants. See below:

The Phoenix housing market is showing signs of improvement, even generating bidding wars among buyers for lower-priced homes.

By Tom Tingle, The Arizona Republic

The area was one of the hardest hit by the foreclosure crisis. Prices had fallen 57% from their peak. Interest rates were near record lows.

Now, “We list a property and, within two or three days, we have multiple offers,” says Keith Krone of Keller Williams Realty in a Phoenix suburb.

While frustrating for buyers attempting to get homes at rock-bottom prices, it’s a healthy sign of healing in a market scorched by the housing bust five years ago, say local Realtors and real estate experts.

The area’s January home sales were up 8.1% year-over-year. Multiple offers are common on lower-end homes, investor-buyers say. And the inventory of homes for sale is now well below the 10-year average, says Michael Orr, real estate expert at Arizona State University.

National data watchers have also seen improvements in Phoenix. In October and November, it was the only one of 20 major cities to see home values rise month-to-month, according to Standard & Poor’s Case-Shiller home price index, which reports December results today.

Phoenix “is probably the best example we have right now of a hard-hit market that’s showing signs of recovery,” says Zillow economist Stan Humphries.

Making money on rentals

Strong demand for rental homes is boosting the market, Orr says.

While home prices plummeted in the downturn, rents haven’t, he says. That’s lured mom-and-pop and institutional investors who are buying single-family homes to turn them into rentals.

In January, more than 25% of homes sold were bought by investors, Orr says. Historically, they account for 10% of Phoenix home purchases.

Investor demand for homes priced below $100,000 is “frenetic,” says Laurie Hawkes, president of American Residential Properties. The real estate investment firm has bought almost 800 Phoenix-area homes in the past three years and turned them into rentals.

Last year, cash buyers accounted for about 94% of purchases for homes that sold for less than $100,000, she says.

The homes are often filled with people who lost single-family homes to foreclosure, Hawkes says.

Job growth in the Phoenix area has also outpaced state and national averages since mid-2011, says a December report on the region by Moody’s Analytics. That drives rental demand, too.

Prices are responding in the lower end of the market, says James Breitenstein, CEO of Landsmith, an investment firm that’s bought 225 Phoenix-area homes in the past year to rent out.

“Houses we used to buy for $50,000 are now creeping up to $60,000 or $70,000,” he says.

Arizona’s relatively fast foreclosure process is also helping to clear inventories of distressed homes. The state is among those that do not require court approvals of foreclosures.

About half the states do, including New York and Florida. In judicial foreclosure states, foreclosures have taken longer to complete. New rules since 2010 to ensure that foreclosures are done properly have extended time frames even more.

In Phoenix, it would take about 20 months — half the national average — to liquidate all homes currently in foreclosure or more than 90 days delinquent on loans, based on current foreclosure sales rates, says mortgage tracker LPS Applied Analytics.

A new government plan launched Monday should hasten the clearing of inventories of distressed homes, says Jim Belfiore, of Belfiore Real Estate Consulting in Phoenix. The government is offering to sell some foreclosed homes owned by Fannie Mae in Phoenix and other cities to investors to turn into rentals.

Improved affordability

In addition to investors, first-time buyers are also active, as are vacation home buyers and people who lost homes earlier in the downturn, says Arthur Welch of Realty World Superstars in the Phoenix suburb of Buckeye.

More traditional buyers are also in the market, Belfiore says. “People who have sat on the sidelines sense that the bottom has been hit,” he says.

When compared against median incomes, Phoenix homes are 15% more affordable now than they were on average from 1985 to 2000, Zillow says. Record-low mortgage rates, around 4%, stretch buyers’ dollars further.

Zillow expects Phoenix home values to rise 0.6% this year, vs. a 3.7% drop for the nation. Through November, Case-Shiller data show Phoenix home values down 3.6% year-over-year vs. a 3.7% decline for an index of 20 leading cities.

Phoenix still faces big challenges.

Last year, the region posted the nation’s sixth-highest metropolitan foreclosure rate, based on foreclosure filings by housing unit, market researcher RealtyTrac says.

As those homes hit the market, they’ll drive home prices lower, says Moody’s analyst Daniel Culbertson. Meanwhile, new single-family home construction will remain “lethargic,” he wrote in the December report.

What’s more, almost half the Arizona homes with mortgages were underwater at the end of September, says researcher CoreLogic. That compares with about a fifth of homeowners nationwide who owe more on their mortgage than their homes are worth.

It’s harder for underwater homeowners to sell and then buy other homes. Normal resales in Phoenix aren’t seeing higher prices yet, Orr says.

Still, he says the market is poised for a “significant rise” in prices at the lower end. “We will have to wait and see if this possibility turns into reality,” he says.

Just sold in Arcadia! Critically-acclaimed 20th century ranch property featured in Alan Hess’s Ranch House book. Nestled between Paradise Valley, the Biltmore, & Camelback Mountain Preserve. Private, luxury living for you, your family, & visiting friends. This 4-bedroom, 3.5-bath single-level beauty features two master suites on opposite sides of the home giving the owner flexibility to […]

Rare find in Arcadia, 4 bed, 3.5 bath + Office, + Basement! Nothing spared in this rebuild: Cul de Sac location,Wolf and Sub Zero appliances, and the incomparable Hopi/Arcadia schools! Only the slab and one wall remain from the original, rebuilt in 2006. 9 ft + vaulted ceilings throughout. The open kitchen features granite countertops, […]

Awesome new listing in Arcadia Proper! Offered at $2,895,000. Completely renovated Arcadia masterpiece featuring a sprawling corner lot with unobstructed views of Camelback Mountain, & one of only four large homes on a meticulously maintained cul de sac. The spectacular update offers 5 bedrooms, 5.5 baths plus an additional large office/flex room. Dream kitchen with […]

Design by Agent Image - Real Estate Website Design | Sitemap